All Categories

Featured

Table of Contents

- – Medicare Providers Near Me Lake Forest, CA

- – Harmony SoCal Insurance Services

- – Low Cost Dental Services For Seniors Without I...

- – Best Partd Insurance Company For Seniors Lake ...

- – Best Dental Insurance Seniors Lake Forest, CA

- – Health Insurance For Seniors Over 60 Lake For...

- – Best Dental Insurance Seniors Lake Forest, CA

- – Medicare Advantage Plans Near Me Lake Forest...

- – Best Dental Insurance For Seniors Lake Fores...

- – Dental Insurance For Seniors Medicare Lake F...

- – Best Insurance For Seniors Lake Forest, CA

- – Seniors Insurance Lake Forest, CA

- – Delta Dental Insurance For Seniors Lake Fore...

- – Best Dental Insurance Seniors Lake Forest, CA

- – Reasonable Dental Insurance For Seniors Lake...

- – Harmony SoCal Insurance Services

Medicare Providers Near Me Lake Forest, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Real protection details differ widely from strategy to strategy. 4 Generally talking, there are 2 main kinds of oral insurance coverage offered for senior citizens that are no much longer qualified for oral advantages with job: If you are 65 or older, you might be qualified to register in a Medicare Advantage plan that supplies some dental care benefits.

Find out more regarding the different sorts of Medicare Advantage plans below. Private oral prepare for seniors are offered from a variety of personal dental insurance business. Dental strategies tend to focus on making preventive care a lot more budget-friendly: A lot of plans cover 100% of preventative care expenses, according to the National Organization of Dental Program.

Low Cost Dental Services For Seniors Without Insurance Lake Forest, CA

PPOs tend to have a a great deal of dental experts "in network," yet plans differ, so check to see if a close-by supplier you such as is in the network before subscribing. These network service providers have pre-negotiated rate discounts, with the insurance company that can assist you save money on all your dental treatment.

, yet there's likewise much less flexibility with a restricted network of service providers. 8 Like HMO health and wellness care plans, participants choose a Main Dental professional and have to go via that supplier for all their treatment, including professional references.

It's crucial to recognize the information of any strategies you are considering. An individual oral insurance plan will cover regular dental treatment examinations, cleanings, and typically x-rays at little or no price to the strategy owner. 9Depending on the details strategy, oral insurance coverage can additionally cover extra substantial oral work like basic extractions and tooth cavity fillings or perhaps major treatments like crowns and bridges.

Best Partd Insurance Company For Seniors Lake Forest, CA

Strategy deductible: Several strategies have a deductible. This is the amount you require to pay before the oral plan starts paying. Fortunately is that routine preventative gos to usually aren't based on the deductible, and as soon as you have actually satisfied the insurance deductible for any kind of various other care, you won't pay it once again till it resets the following year.

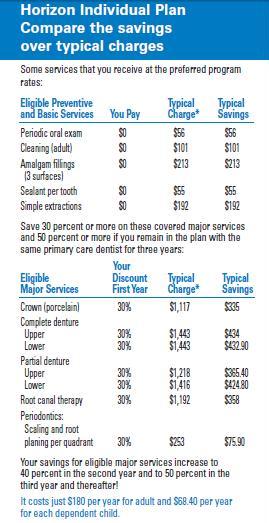

Occasionally, it's a percent of the fee: some strategies cover significant care at 50% meaning 50% of the expenses will be your responsibility. But remember: when you see a network PPO dental practitioner, that charge may have already been discounted by concerning 30%, so at the end of the day, your out-of-pocket cost may just be 35% of the complete "listing" cost.

Finding the best Medicare Benefit strategy for your needs requires closely considering your spending plan, health care demands, and the strategies readily available in your location. Medicare Benefit strategies are used by exclusive insurance firms that have gotten government authorization. Not all Medicare Benefit prepares offer senior citizens dental insurance protection. You might wish to consider a comprehensive plan that covers more complicated oral treatment, such as implants or dentures.

Comprehending exactly how dental insurance coverage for senior citizens jobs can help you make best use of advantages and stay clear of unanticipated prices. A set monthly expense maintains your plan active. Predictable repayments for peace of mind. Examinations, cleansings, and x-rays are commonly covered 100%. Stops small problems from coming to be big costs. Dental fillings, crowns, or dentures are partly covered.

Best Dental Insurance Seniors Lake Forest, CA

Each plan has an annual protection limitation. Choose the ideal plan based upon your dental demands. See Delta Dental dental experts for pre-set lower prices. Guarantees the most significant cost savings on every visit. Use within thirty days of retired life to ensure continuous protection and miss any kind of waiting durations for your new oral plan.

Best for seniors that only need preventative services. Balanced strategy covering precautionary treatment plus corrective solutions like bridges and crowns. Suitable for seniors who desire extensive insurance coverage at a modest costs. Enhanced coverage with a greater annual advantage maximum and lower out-of-pocket costs. Best for seniors anticipating major dental work or requiring extensive solutions like dentures or implants.

Health Insurance For Seniors Over 60 Lake Forest, CA

Coverage for procedures to deal with sophisticated oral issues., consisting of alternatives for seniors with varying requirements, whether you're looking for basic care or more extensive dental job.

Below are some means to find the ideal oral insurance for seniors on Medicare. Initial Medicare does not cover oral health so you'll desire to think about options for oral coverage. Think about Medicare Benefit plans with dental advantages.

Review policy protection very carefully. Call companies promoting their items. Elders on Medicare have lots of choices for dental protection.

Periodontal disease increases the risk of heart problem. Older adults with bad oral hygiene who smoke go to enhanced threat of microbial pneumonia. They also deal with increased threat of dental cancers cells. While rare, some 54,000 situations or dental cancer cells are anticipated to be diagnosed in the USA this year.

Best Dental Insurance Seniors Lake Forest, CA

Those who supply Medicare Supplement (Medigap) extremely often additionally supply senior oral strategies. Dental insurance coverage within these plans is typically included (complimentary).

Many people only focus on the medical or health-related aspects of Medicare when they turn 65. That is reasonable because deciding what's the finest health-plan option can be perplexing enough. Oral is an important part and needs to at least be considered as an aspect when comparing choices.

And, these strategies typically promote the fact that they consist of cost-free included advantages. Oral is frequently pointed out as one of the added advantages. Yet that's where the similarity ends. What strategies cover and what restrictions exist can differ. And they can be fairly significant. Request details to be defined in creating.

Opportunities are you currently have a dental expert. If you like your dentist, do you wish to proceed utilizing them? Check carefully to see if your dental professional is coverage by a certain oral strategy you are taking into consideration. He or she likely knows much better than any person what oral insurance for senior citizens plans are best.

Medicare Advantage Plans Near Me Lake Forest, CA

An agent usually represents simply one insurance coverage business. A broker usually is independent and represents multiple insurance policy business. At least understand why they may be suggesting a certain insurance strategy.

There are benefits and drawbacks for every strategy. Some insurer provide numerous strategies to contrast. It pays to collaborate with somebody who can assist you compare strategies from these service providers: Aetna Aflac Cigna Delta Dental Humana Renaissance Dental United Healthcare Discover Most Current Find Discover more regarding options.

Best Dental Insurance For Seniors Lake Forest, CA

The firm uses 2 dental plans, Mutual Oral Defense and Common Dental Preferred, along with a vision motorcyclist and an oral financial savings strategy. The least expensive oral plan begins at an estimated $29.27 per month, although expenses will certainly vary by place. You can pick from annual maximum advantages of up to $5,000 to tailor the insurance coverage to your demands.

Costs and motorcyclist costs vary, nonetheless, and plans are not readily available in all 50 states. We looked into plan quotes for Miami, Florida. The Common Dental Defense strategy costs about $29.27 per month with a $100 calendar year insurance deductible. It covers preventive solutions completely, 50% of fundamental services, and 20% of major solutions on the first day (50% of major services after year one).

The Shared Dental Preferred plan sets you back regarding $56.38 each month. It has no insurance deductible for precautionary services, but there's a $50 deductible for standard and major services. Its preventative and significant solutions protection coincides as the Defense strategy, yet the Preferred plan covers 80% of standard solutions contrasted to the Protection strategy's 50%.

Dental Insurance For Seniors Medicare Lake Forest, CA

You may have obtained away with regular dental tests and cleanings in your younger years. Yet older grownups' teeth may call for more intricate therapy. An oral plan that only covers you for precautionary care will not aid you pay for extra pricey oral treatments and treatments if you need them.

Find out what degrees of oral insurance coverage you may require. In the oral plan records, they may be called "courses" of protection.

When you satisfy your dental deductible, that percentage demonstrates how much of the cost your plan will certainly pay for these treatments. Seek these details treatments in the plan files. They may be included under standard or major restorative treatment. That indicates you could have some percent of expenses covered once you fulfill your deductible.

Store for an oral strategy that supplies a portion of coverage. If you anticipate to need dental implants, store for an oral plan that particularly includes protection for dental implants.

Best Insurance For Seniors Lake Forest, CA

Will you need an origin canal, bridge, or implants? Do you require dentures? Shop for dental plans that assist cover these sorts of major restorative care, so you don't have to pay the entire price on your own. Standalone dental plans from an exclusive insurer or an oral discount strategy can cover greater than just precautionary treatment If you pick to look for a standalone oral plan, search for protection that includes "major corrective" advantages.

Your plan can also. Give us a phone call and we'll make sure you always have the best strategy for your upcoming care. Savings may differ by supplier, location, and plan.

It can additionally assist avoid tiny problems from coming to be large problems by urging routine oral health check outs and appointments, due to the fact that plans generally lower or even eliminate the expense of these preventative brows through. Excellent oral protection may additionally give more predictability in costs for those living on a set income.

Seniors Insurance Lake Forest, CA

Typically the only times that dental treatments might be covered by Medicare are when therapy is deemed necessary to proceed with a typical medical demand. For example, if you're being dealt with for oral cancer cells (which would certainly fall under conventional clinical treatment), a tooth removal to promote treatment can be covered by Medicare.

Actual insurance coverage details differ widely from plan to plan. Several Medicare Advantage plans have very restricted dental benefits and in any kind of case, it's approximated that around 65% of Medicare recipients had no oral insurance coverage. 4 Generally talking, there are two main sorts of oral insurance coverage offered for senior citizens who are no more eligible for dental benefits via job: If you are 65 or older, you may be eligible to enroll in a Medicare Benefit strategy that provides some oral care advantages.

Delta Dental Insurance For Seniors Lake Forest, CA

Find out more regarding the different kinds of Medicare Benefit plans right here. Specific oral strategies for elders are available from a variety of exclusive oral insurer. Dental strategies often tend to concentrate on making preventive care extra affordable: Most strategies cover 100% of preventative treatment expenses, according to the National Organization of Dental Program.

PPOs have a tendency to have a lot of dental professionals "in network," however strategies differ, so inspect to see if a neighboring carrier you such as remains in the network prior to authorizing up. These network carriers have pre-negotiated rate discounts, with the insurer that can aid you conserve on all your oral treatment.

These dental plans have a tendency to use reduced costs and deductibles, but there's also much less versatility with a minimal network of providers. 8 Like HMO health treatment strategies, participants select a Main Dental professional and have to go through that company for all their treatment, including specialist referrals. Several DHMO oral plans have no deductibles or caps and while there might be a flat-rate copayment for non-preventive therapies, your general expenses will likely be lower.

It's vital to comprehend the details of any kind of strategies you are taking into consideration. A private dental insurance coverage plan will certainly cover routine dental treatment appointments, cleanings, and usually x-rays at little or no price to the strategy holder. 9Depending on the details plan, oral insurance coverage can also cover extra considerable dental job like simple removals and cavity dental fillings or even major treatments like crowns and bridges

Best Dental Insurance Seniors Lake Forest, CA

Plan deductible: Numerous plans have an insurance deductible. This is the amount you require to pay before the oral plan begins paying. Fortunately is that normal preventive brows through commonly aren't based on the insurance deductible, and when you've fulfilled the deductible for any kind of other treatment, you won't pay it once again until it resets the list below year.

In some cases, it's a percent of the fee: some plans cover significant care at 50% significance 50% of the costs will certainly be your obligation. Yet keep in mind: when you see a network PPO dental expert, that cost may have already been marked down by regarding 30%, so at the end of the day, your out-of-pocket price might only be 35% of the full "checklist" price.

Reasonable Dental Insurance For Seniors Lake Forest, CA

This is the most that the strategy will pay in a given year $2,000, for instance. If your care surpasses this optimum, the remaining cost might be your obligation.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

With 6.67/ 10 factors, MetLife rates in 3rd place. It is the only company with an A+ ranking from AM Finest, making it second just to Guardian (A++). It is third best in the Ton of money 500 ratings with a ranking of 46. Started in 1868, this business is the 4th oldest company we evaluated.

Eye And Dental Insurance For Seniors Lake Forest, CABest Dental Insurance For Seniors Lake Forest, CA

Hearing Insurance For Seniors Lake Forest, CA

Senior Health Insurance Lake Forest, CA

Find A Seo Companies Lake Forest, CA

Around Here Seo For Law Firms Lake Forest, CA

Delta Dental Insurance For Seniors Lake Forest, CA

Harmony SoCal Insurance Services

Table of Contents

- – Medicare Providers Near Me Lake Forest, CA

- – Harmony SoCal Insurance Services

- – Low Cost Dental Services For Seniors Without I...

- – Best Partd Insurance Company For Seniors Lake ...

- – Best Dental Insurance Seniors Lake Forest, CA

- – Health Insurance For Seniors Over 60 Lake For...

- – Best Dental Insurance Seniors Lake Forest, CA

- – Medicare Advantage Plans Near Me Lake Forest...

- – Best Dental Insurance For Seniors Lake Fores...

- – Dental Insurance For Seniors Medicare Lake F...

- – Best Insurance For Seniors Lake Forest, CA

- – Seniors Insurance Lake Forest, CA

- – Delta Dental Insurance For Seniors Lake Fore...

- – Best Dental Insurance Seniors Lake Forest, CA

- – Reasonable Dental Insurance For Seniors Lake...

- – Harmony SoCal Insurance Services

Latest Posts

Water Heater Maintenance Rancho Penasquitos

Miramar Water Heater Repair Near Me

Faucet Repairs Encinitas

More

Latest Posts

Water Heater Maintenance Rancho Penasquitos

Miramar Water Heater Repair Near Me

Faucet Repairs Encinitas