All Categories

Featured

Table of Contents

- – Senior Insurance Laguna Woods, CA

- – Harmony SoCal Insurance Services

- – Health Insurance For Seniors Laguna Woods, CA

- – Senior Insurance Laguna Woods, CA

- – Seniors Insurance Laguna Woods, CA

- – Delta Dental Insurance For Seniors Laguna Woo...

- – Health Insurance For Seniors Laguna Woods, CA

- – Medicare Insurance Agent Near Me Laguna Wood...

- – Eye And Dental Insurance For Seniors Laguna ...

- – Senior Dental Insurance Laguna Woods, CA

- – Best Partd Insurance Company For Seniors Lag...

- – Hearing Insurance For Seniors Laguna Woods, CA

- – Insurance For Seniors Laguna Woods, CA

- – Low Cost Dental Services For Seniors Without...

- – Harmony SoCal Insurance Services

Senior Insurance Laguna Woods, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

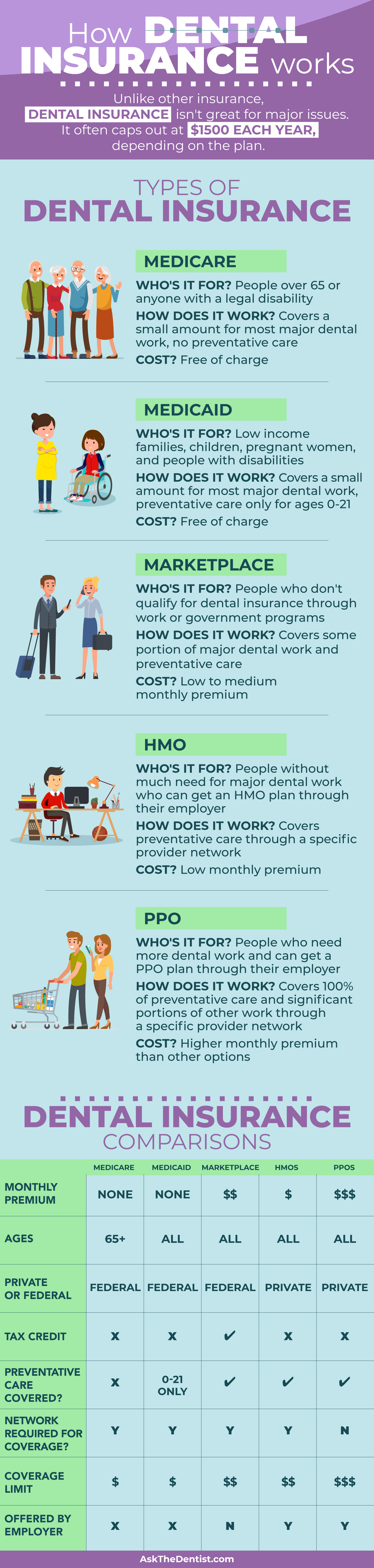

Monthly costs as low as $44.01 for individual Affordable rate for partner Guaranteed Issue (no wellness inquiries) The dental strategy from GTL is among the only intend on the market that does NOT use a network of dental experts. This suggests you can literally go see any dental professional that you want.

Just pay the dental expert ahead of time, after that supply your agent with the itemized invoicing to file the claim. What we such as concerning it:. Developed in hearing advantage Constructed in vision advantage Monthly premiums as low as $46.25 for private Guaranteed Problem (no wellness inquiries) Finding the appropriate dental insurance policy for senior citizens on Medicare can be tough, but not difficult.

While we have actually detailed some wonderful plans over, make certain to call us at (800 )924-4727 to see what various other plans we have offered in your state. Fortunately, Medicare provides insurance coverage for fairly a little bit of our medical care, and even some oral when it is truly health and wellness related. Medicare covers dental solutions such as regular dental care, emergency oral, dentures and a lot more.

Health Insurance For Seniors Laguna Woods, CA

Dentures, dental implants are one of the other problems that numerous retirees are worried about. While oral implants completely secure prosthetic teeth right into the gum line, this procedure is additionally NOT covered by original Medicare Some stand-alone dental insurance prepare for elders on really supply advantages for dental implants.

The expense for these strategies are really budget-friendly, but the prices will be straight related to the amount of yearly advantages the plan will certainly pay out each year. Many Medicare Benefit plans offer a minimal advantage for dental protection.

There is no one-size-fits-all solution to this concern, as the finest dental strategy for senior citizens depends on numerous elements, such as your budget plan, oral health and wellness requirements, and personal preferences. Before selecting a dental plan, do your research, contrast prices and testimonial benefits. Yes! Lot of times the quantity of protection a person may have with a Medicare Benefit plan is much less than what they prefer.

This person might buy a stand-alone dental strategy that gives them with an added $1,000 of advantages every year for a marginal monthly cost. Of training course they might likewise select to amount to an extra $5,000 each year in benefits if it is cost effective to them. The solution to this question depends upon individual circumstances and choices.

Senior Insurance Laguna Woods, CA

Additionally, some senior citizens on Medicare do not like the sensation of dentures. Dental implants can last for years, which can make them an economical long-lasting investment. Full mouth dental implants refer to the replacement of all teeth with implants. This treatment is extra complex and time-consuming than single tooth implants and might call for additional therapies, such as bone grafting or sinus lift.

It is essential to request for a comprehensive therapy plan and cost quote from your dental practitioner. Medicare Component B might spend for a dental examination if it is needed to be finished before a procedure has the ability to be executed such as open heart surgical treatment. In enhancement, for these solutions to be covered you should have an underlying health and wellness problem.

Seniors Insurance Laguna Woods, CA

Exclusive are one of one of the most preferred options that we see individuals use to cover dental treatment. Much of these strategies additionally supply added benefits to assist cover vision and hearing too. If you are enlisted in a Medicare Benefit plan you can inspect your strategy advantages to see if dental is an advantage, or if you can include extra insurance coverage for these advantages.

Some various other bottom lines to remember: A lot of dental insurance coverage under Medicare Advantage Strategies have a protection restriction which might be less than an exclusive oral plan. Many costs sustained will require you to pay a co-insurance as opposed to a little co-pay. May restrict exactly how commonly they cover a particular dental benefit.

Conventional Medicare nor Medicare Supplement prepares cover teeth cleansings. This is one more reason that it is a good idea for elders to consider dental insurance policy strategies. Professionals might be eligible for minimized expense oral care or insurance policy. If you are an expert, then you can start here to see if you qualify for those advantages.

Delta Dental Insurance For Seniors Laguna Woods, CA

Ideally, this article helped to minimize some of your concerns concerning who would certainly finish up paying for dental care, implants, and dentures. Medicare insurance coverage of dental services can often be a little bit complicated.

* Not all plans are offered in all states. We are below to assist. Call us today! Monday Firday: 9am 5pm ESTSat & Sun: Closed We are below to assist. Contact us today! Monday Firday: 8am 4pm ESTSat & Sunlight: Shut We are below to aid. Get in touch with us today! Monday Firday: 9am 5pm ESTSat & Sun: Closed.

Health Insurance For Seniors Laguna Woods, CA

Below are some means to find the finest dental insurance coverage for elders on Medicare. Initial Medicare does not cover dental wellness so you'll desire to consider choices for dental insurance coverage. Consider Medicare Benefit intends with oral advantages.

Review plan protection very carefully. Get a 2nd viewpoint from a local insurance coverage specialist. Elders on Medicare have numerous alternatives for dental insurance coverage.

Gum tissue illness increases the threat of heart illness. Older grownups with poor dental health who smoke go to increased risk of microbial pneumonia. They also deal with boosted danger of oral cancers cells. While uncommon, some 54,000 situations or oral cancer are anticipated to be detected in the United States this year.

Medicare Insurance Agent Near Me Laguna Woods, CA

Those that use Medicare Supplement (Medigap) very usually additionally supply elderly oral plans. Representatives that use Medicare Advantage (MA) strategies must be a source you turn to as well. Dental coverage within these plans is often included (cost-free). Benefits can differ significantly and are hardly ever detailed in the advertising product.

A lot of people only focus on the medical or health-related aspects of Medicare when they turn 65. That is easy to understand due to the fact that deciding what's the best health-plan choice can be perplexing sufficient. Oral is an important component and needs to at least be weighed as an element when contrasting alternatives.

And, these strategies typically advertise the reality that they include cost-free added advantages. Dental is typically mentioned as one of the included benefits. Yet that's where the resemblance finishes. What strategies cover and what restrictions exist can differ. And they can be fairly considerable. Ask for information to be defined in composing.

Opportunities are you already have a dental practitioner. If you like your dental expert, do you desire to continue utilizing them? Check thoroughly to see if your dental expert is protection by a particular oral strategy you are thinking about. He or she likely recognizes far better than anyone what dental insurance for seniors plans are best.

Eye And Dental Insurance For Seniors Laguna Woods, CA

The terms insurance agent and insurance broker appear to suggest the very same point. That's not real. A representative normally stands for just one insurance provider. A broker generally is independent and stands for numerous insurance provider. Is one far better than the other? No. At least know why they might be suggesting a certain insurance coverage plan.

There are advantages and disadvantages for every plan - Laguna Woods Health Insurance For Seniors Without Medicare. Some insurance coverage companies offer numerous strategies to compare. It pays to function with somebody that can aid you compare plans from these service providers: Aetna Aflac Cigna Delta Dental Humana Renaissance Dental United Medical Care Find Most Recent Find Find out more regarding choices

While some Veterans registered in VA wellness treatment are qualified totally free oral care from our companies, numerous are not. Others may be eligible absolutely free care for some, however not all, of their oral requirements. VADIP can help you acquire private oral insurance coverage at a reduced cost. you can buy a VADIP strategy if you want added dental insurance.

Senior Dental Insurance Laguna Woods, CA

If you were covered during that time, you'll require to sign up again to obtain brand-new protection. You should know that some of the plan options and costs may have altered.

It can additionally assist avoid little issues from becoming large issues by urging regular oral wellness sees and checkups, since strategies normally lower or even get rid of the expense of these preventative sees. Good oral insurance coverage might likewise give more predictability in costs for those living on a set revenue. Requirement Medicare (Part A and Part B) does not cover oral care in the majority of situations.

Best Partd Insurance Company For Seniors Laguna Woods, CA

Real coverage details differ widely from plan to plan. 4 Extensively speaking, there are two primary kinds of dental protection available for seniors who are no much longer qualified for dental benefits with job: If you are 65 or older, you may be qualified to register in a Medicare Benefit strategy that supplies some oral treatment advantages.

Find out much more about the various kinds of Medicare Benefit plans here. Specific dental prepare for senior citizens are readily available from a range of personal dental insurance provider. Dental plans tend to concentrate on making preventive care a lot more cost effective: Most plans cover 100% of preventative treatment expenses, according to the National Association of Dental Program.

PPOs tend to have a a great deal of dental professionals "in network," yet strategies differ, so check to see if a nearby carrier you like is in the network prior to joining. These network providers have pre-negotiated price discounts, with the insurance coverage company that can aid you save money on all your oral treatment.

Hearing Insurance For Seniors Laguna Woods, CA

These oral strategies tend to offer lower costs and deductibles, but there's likewise less flexibility with a restricted network of suppliers. 8 Like HMO wellness treatment plans, members choose a Key Dental expert and need to go through that company for all their treatment, including professional references. Many DHMO oral strategies have no deductibles or caps and while there might be a flat-rate copayment for non-preventive treatments, your overall prices will likely be lower.

It is essential to understand the details of any kind of strategies you are taking into consideration. A specific oral insurance plan will certainly cover regular oral care appointments, cleansings, and frequently x-rays at little or no cost to the strategy holder. 9Depending on the particular strategy, dental insurance policy can also cover more substantial oral job like basic extractions and cavity dental fillings and even major procedures like crowns and bridges.

Strategy deductible: Several strategies have an insurance deductible. This is the quantity you require to pay prior to the oral plan starts paying. The bright side is that regular preventative brows through usually aren't subject to the deductible, and once you've satisfied the insurance deductible for any type of other care, you will not pay it once again up until it resets the list below year.

In some cases, it's a percentage of the fee: some strategies cover significant treatment at 50% meaning 50% of the costs will be your duty. But remember: when you see a network PPO dentist, that fee may have already been discounted by concerning 30%, so at the end of the day, your out-of-pocket price might just be 35% of the full "checklist" cost.

Insurance For Seniors Laguna Woods, CA

Nonetheless, actual protection information differ extensively from strategy to strategy. Numerous Medicare Advantage plans have extremely restricted oral advantages and in any type of situation, it's approximated that around 65% of Medicare beneficiaries had no oral insurance coverage. 4 Broadly talking, there are two major sorts of dental protection offered for senior citizens who are no more eligible for oral advantages with work: If you are 65 or older, you might be eligible to register in a Medicare Benefit plan that provides some dental treatment benefits.

Discover more regarding the different kinds of Medicare Benefit intends here. Private dental strategies for seniors are offered from a range of personal dental insurance provider. Oral strategies have a tendency to concentrate on making preventative care more cost effective: Many plans cover 100% of preventative treatment prices, according to the National Association of Dental Program.

PPOs have a tendency to have a large number of dental professionals "in network," yet plans differ, so examine to see if a neighboring supplier you like is in the network before authorizing up. These network suppliers have pre-negotiated price discounts, with the insurer that can assist you save money on all your dental treatment.

, yet there's likewise much less flexibility with a limited network of companies. 8 Like HMO wellness care strategies, members select a Main Dental practitioner and have to go through that company for all their care, including professional recommendations.

Low Cost Dental Services For Seniors Without Insurance Laguna Woods, CA

It is very important to understand the information of any plans you are taking into consideration. In many cases, a private oral insurance coverage plan will cover regular oral care check-ups, cleanings, and usually x-rays at little or no charge to the strategy owner. 9Depending on the particular strategy, oral insurance policy can likewise cover extra substantial oral job like straightforward removals and dental caries dental fillings or even major procedures like crowns and bridges.

Strategy deductible: Many strategies have an insurance deductible. This is the quantity you require to pay prior to the dental strategy starts paying. The bright side is that routine precautionary visits typically aren't subject to the deductible, and when you've met the insurance deductible for any type of various other care, you will not pay it once more till it resets the list below year.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

In some cases, it's a percentage of the fee: some strategies cover major care at 50% definition 50% of the expenses will certainly be your responsibility. Keep in mind: when you see a network PPO dentist, that cost may have currently been discounted by concerning 30%, so at the end of the day, your out-of-pocket expense might only be 35% of the complete "checklist" cost.

Reasonable Dental Insurance For Seniors Laguna Woods, CABest Dental Insurance Seniors Laguna Woods, CA

Insurance For Seniors Laguna Woods, CA

Medicare Dental Insurance For Seniors Laguna Woods, CA

Finding A Good Seo Consultant Laguna Woods, CA

Finding A Local Seo Services For Small Business Laguna Woods, CA

Harmony SoCal Insurance Services

Table of Contents

- – Senior Insurance Laguna Woods, CA

- – Harmony SoCal Insurance Services

- – Health Insurance For Seniors Laguna Woods, CA

- – Senior Insurance Laguna Woods, CA

- – Seniors Insurance Laguna Woods, CA

- – Delta Dental Insurance For Seniors Laguna Woo...

- – Health Insurance For Seniors Laguna Woods, CA

- – Medicare Insurance Agent Near Me Laguna Wood...

- – Eye And Dental Insurance For Seniors Laguna ...

- – Senior Dental Insurance Laguna Woods, CA

- – Best Partd Insurance Company For Seniors Lag...

- – Hearing Insurance For Seniors Laguna Woods, CA

- – Insurance For Seniors Laguna Woods, CA

- – Low Cost Dental Services For Seniors Without...

- – Harmony SoCal Insurance Services

Latest Posts

Slab Leak Plumbers Del Mar

Santee Water Line Repair

Emergency Plumber Cardiff-By-The-Sea

More

Latest Posts

Slab Leak Plumbers Del Mar

Santee Water Line Repair

Emergency Plumber Cardiff-By-The-Sea